One of the apparent “insidiousnesses” that “beleaguer” Slovak entrepreneurs in Germany is the withholding tax. Its purpose is to prevent tax evasion by unregistered entities. When carrying out construction work in connection with real estate, the client is obliged to withhold 15% withholding tax from the invoices and pay it to the German tax authorities. This can only be avoided if the supplier presents the customer with a valid withholding tax exemption certificate issued by the German tax authorities.

15% down

If you do not have such a certificate as a supplier, you will not avoid withholding tax. And this applies to the entire subcontracting chain. Thus, if you have other subcontractors under you as a contractor, you are equally obliged to withhold the 15 per cent tax from them (simply said –consult a professional) if they do not submit a valid withholding tax exemption certificate. It makes no difference whether the client for your work is a German company or a foreign company operating in Germany.

How to get Freistellung

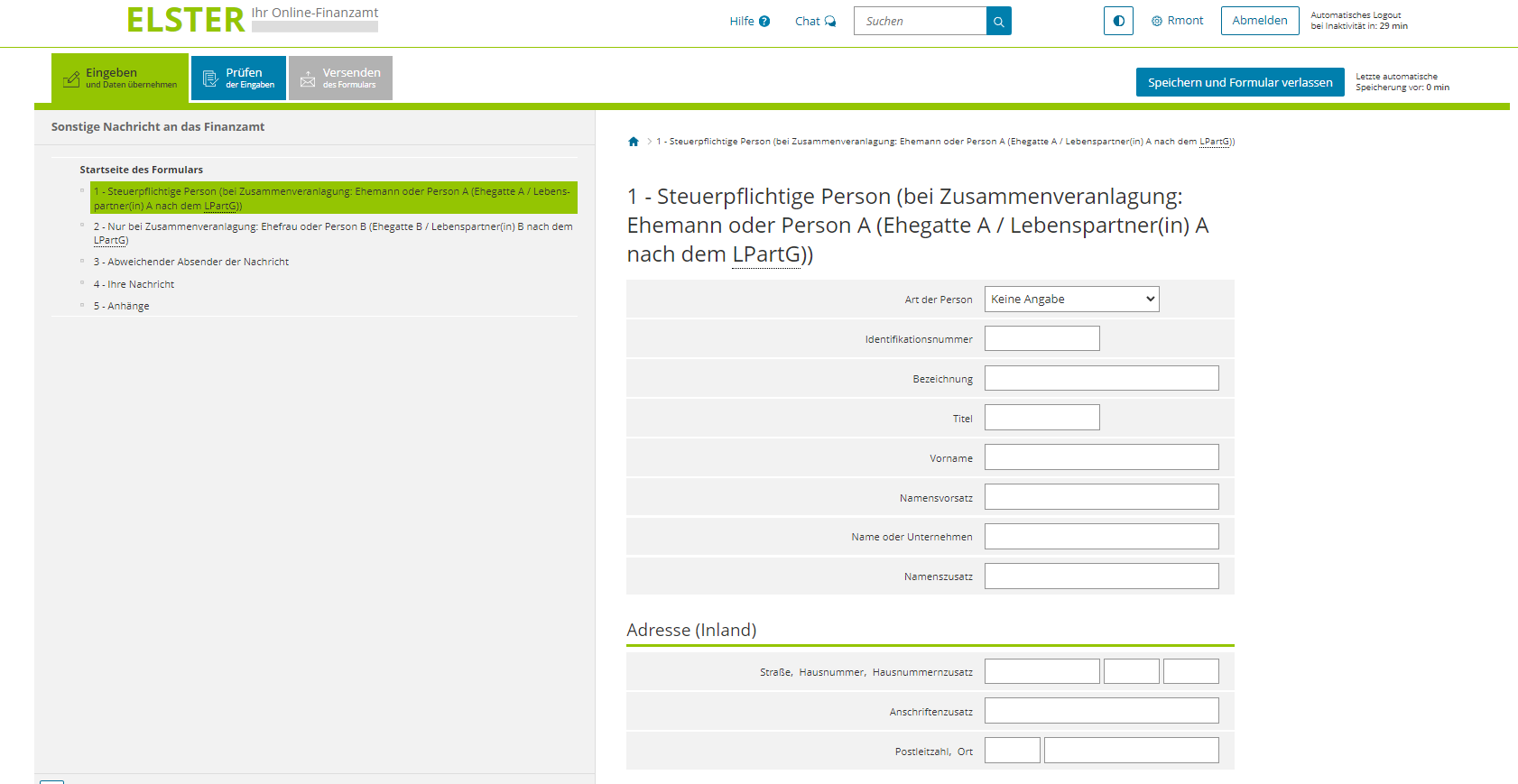

Therefore, one of the things that Slovak companies operating in the construction industry in Germany are most interested in is Freistellung – exemption from withholding tax. How do you get it from the German tax office? The basic prerequisite is that you register with the tax office on time, fulfil all tax obligations and fill in the necessary documents correctly.

It should be remembered that obtaining Freistellung is not automatic and it also takes time. That is why it is advisable to have a professional advisor to help you through the process of obtaining a withholding tax exemption and ensure that all the necessary steps are done correctly.

Why is it important?

Freistellung in the meantime, the 15 percent tax withheld will not be refunded automatically, but only based on a separate application after the end of the calendar year. To avoid this situation and not wait until next year for your money, but have it available every month, contact the experts for doing business in Germany.

Doing business in Germany is tempting for Slovaks, but it also has many pitfalls. That is why it is very important to keep up to date with local tax obligations and rules. The German system is strict and mistakes are not forgiven. That is why it is a good idea to have experienced advisers on hand to guide you safely through the maze of foreign tax obligations and help you run your business calmly and successfully. We have such advisers at Profidecon. We are already assisting dozens of Slovak companies and tradesmen operating on the German construction market. In the Freistellung area alone, we have already processed more than 1,000 individual cases. We will be happy to help you, too.